Brands take note: The purpose of purpose is purpose

Marketers are still fixated on the notion that purpose drives growth, when the whole point is that for most brands it will cost money and require sacrifice. Just look at Patagonia.

I wonder if your newsfeed, like mine, has been deluged with images of the wizened, unsmiling face of Yvon Chouinard? The 83-year-old is the founder of Patagonia – a company long revered as a genuine exemplar of brand purpose.

And for good reason. Chouinard has just made headlines by relinquishing his ownership of the company to a trust. Patagonia’s profits will no longer go to him but to the fight against climate change. “Instead of ‘going public’,” Chouinard explained, “you could say we’re ‘going purpose’.”

The move will cost him dear. Aside from giving up an asset worth around £2.6bn, along with all the associated future profits, Chouinard will also have to pay tax as a result of his generous donation. None of this is likely to come as any surprise to the great man. He surely understands one of the central precepts of purpose; that it must cost you something to deliver it.

It’s a point that largely escapes the army of marketers who applauded Chouinard’s move with supportive posts that included their personal take on brand purpose. Marketers have developed their own very special strain of brand purpose in recent years, one that does not require purpose to cost them anything at all. In fact most marketers operate under the delusion that they can have their purpose cake and eat it too.

Marketers, it would appear, are now looking at the grey skies above and acknowledging they might have drunk a little too much from the (100% recycled) bottle of purpose Kool-Aid.

Because customers apparently prioritise purpose, they will buy the brand more often and for higher prices, thus enabling marketers to deliver not only a purposeful company but one that is fiscally superior too. Not only does purpose come without cost, it actually delivers more profit! How good is that? And it’s all backed up by data.

In 2020, in a much-quoted survey, Zeno told us that 94% of global customers said it was important that companies they engaged with had a strong purpose. These customers were four times more likely to buy, trust and champion brands that they believed exhibited clear and authentic brand purpose.

A year later, Havas told us that 64% of the world’s population prefer to buy from companies with a reputation for having a purpose other than just profit and most were prepared to pay more for the privilege too. A similar study from Razorfish concluded that 82% of consumers said the brands they buy (and 75% of the brands their friends buy) stand for a greater mission/purpose.

With proportions like these, it’s easy to see why marketers focused so heavily on purpose and why so many thought leaders concluded that without purpose a brand was likely to fail.

Patagonia is ‘going purpose’ as founder gifts company to climate crisis fight

“Companies that lead with purpose and build around it can achieve continued loyalty, consistency and relevance in the lives of consumers,” Deloitte’s head of brand and growth strategy concluded in 2020. “Those that fail to identify and articulate their purpose may survive in the short term, but over time, people are likely to demand more.”

Most of the data used to support the case for brand purpose is verbal, spoken data which lays itself open to the ‘intention-action gap’ that exists between what people say they will do and what actually transpires. That gap is particularly large with topics like brand purpose because social desirability bias leads respondents to, knowingly or unknowingly, overclaim the importance of purpose in their purchase decisions in order to look less like a wanker.

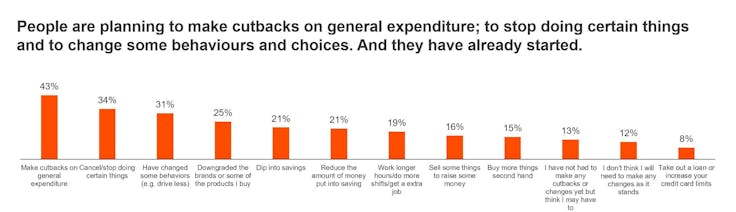

But there is a bigger, more pressing question now being asked of brand purpose. As we enter a recession, we know – from bitter past experience – that customers will change their behaviour in the tricky months ahead. In May, Kantar was already showing a significant proportion of the market (albeit, again, with spoken rather than derived data) switching to lower priced options. Such moves are not a uniform downgrade of every brand for a cheaper alternative. In order to justify the continued purchase of some premium brands that are deemed different and meaningful enough to retain their place, customers trade down on weaker, less essential fare.

Purpose could work either way in this new, bleaker purchase context. If the research on the appeal of purpose is legitimate and brands really have delivered a purposeful proposition to customers that prioritise such things, then their place in the shopping basket will be maintained. But if purpose has been overclaimed by customers, overstated by marketers or poorly executed in the market, then the encroaching recessionary cat is about to get among the purpose pigeons and feathers will fly.

This is not a binary prediction. Some pigeons will escape, some won’t. It’s over-simplistic to claim purpose always works or that it always doesn’t. Purpose can be a legitimate, effective positioning strategy; not just for paragons like Patagonia but a raft of other more prosaic brands. But it has also been overplayed by many marketers keen to look cool and ride the purpose wagon to their next big job.

And that duality of outcomes can even occur within the same company. Unilever is having a torrid time because it pinned its corporate fortunes on brand purpose.

Gradually, it seems marketers are developing a more mature brand purpose mindset. About time.

That makes sense when you look at a brand like Dove, which – partly because of the nature of its category, consumers and competitors, and partly because of the expert and committed manner in which Unilever built the ‘Campaign for Real Beauty’ – remains one of the great commercial case studies for purpose. But, in what can only be described as a dumbfounding move, Unilever made the undergraduate brand architecture error of applying the same strategy across its entire house of brands portfolio.

Rather than letting each brand bloom in its own highly distinct manner, Unilever attempted to enforce purpose on every one of its remaining brands. Unlikely ones like Magnum, Pot Noodle and Hellmann’s.

That last brand is a particularly potent example of the perils of purpose. If Unilever lowered its rose-tinted spectacles for a second and looked properly at Hellmann’s, it could craft a classic recession-busting position based on the value of being able to create meals from leftovers using the magical white stuff. Instead, it has been focused on the hilariously misplaced idea of going further up the benefit ladder to the esoteric appeal of helping to reduce the world’s food mountain. Try selling that to a pensioner in Doncaster Morrisons worried about her central heating bill.

In non-recessionary times, this folly can be ignored as an unfortunate side effect of the good times. But now the recession cat is loose. And the fatter, more indulgent pigeons look vulnerable.

To be fair to Unilever, there is a sense that the company is now all too aware that it went too far for both consumers and investors with its brand purpose fundamentalism. Hanneke Faber, Unilever’s president of foods and refreshment, and very much its chief purpose advocate, continues to cite Hellmann’s purpose as a prime reason for growth. But recently that dogma has been balanced with a hefty dose of pre-recession pragmatism.

“Hellmann’s purpose – fighting food waste – has grown brand power, and brand power drives market share and in turn growth,” Hanneke recently explained to the Financial Times. “But purpose is the icing on the cake, it’s not the cake itself.”

Marketers, it would appear, are now looking at the grey skies above and acknowledging they might have drunk a little too much from the (100% recycled) bottle of purpose Kool-Aid. That was certainly Marc Pritchard’s message earlier this year in and around Cannes. Procter & Gamble’s chief brand officer has overseen plenty of his own purpose disasters – not least the Gillette debacle a few years back – but now he openly acknowledges that companies are over-leveraging purpose at the expense of brand growth, and that this will hurt them when the recessionary cat starts prowling.

Gillette’s new ad will trash its sales and be the year’s worst marketing move

“The industry in general has just gone too far into the good and potentially not paying enough attention to growth,” he told a conference audience in June. P&G’s pre-Covid and pre-recession mantra was to be “a force for good and a force for growth”. But Prichard has now reversed those priorities and put growth ahead of good.

“The order matters,” he told the same conference audience, “because first and foremost we’re in business. Our job is to innovate on our products. Our growth drives economic good. Growth drives jobs. And it decides the partners you work with, the retailers you work with. And then it enables you to do more good for society and planet. Force for growth leads to being a force for good.”

Gradually, it seems marketers are developing a more mature brand purpose mindset. About time. Most customers aren’t going to make their selections based exclusively on the ethos of the company behind the brand. Purpose is not a panacea that every brand must adopt or fail. And, even when successfully adopted and implemented, brand purpose might not deliver any corporate growth. It might even hinder it.

But that’s not, as a significantly less rich Yvon Chouinard will surely confirm, an argument against purpose. Indeed, it might be the whole point. Purpose is not usually the path to greater profits and better growth. That handy, naïve, entirely specious narrative needs to end. The purpose of purpose is purpose. You deliver it because you believe in it. You deliver it even when it costs you something – everything, even your whole company.